Abstract

This paper analyzes the interactions of the regulation of distribution networks and electricity supply security. In particular, the hypothesis is tested that output-based regulatory frameworks, which implicitly take into account quality-of-supply-criteria, improve the level of reliability vis à vis purely incentive-based schemes. To do so, novel empirical evidence is analyzed based on a cross-country panel data set covering 27 countries for the period from 1999 to 2013. Regional heterogeneity and potential endogeneity are controlled for. We find that the introduction of output-based regulation, ceteris paribus, leads to reductions of the annual outage duration by 16.05 % on average when compared to incentive-based systems. Given the substantial economic costs of power outages, marginal reliability improvements have considerable economic effects, which can now be quantfied. In the, admittedly hypothetical, case that EU member states, who have not yet done so, were to implement quality-controlling regulation, macroeconomic benefits amount to 930 m. € p.a. The findings support the argument that the value of electricity supply security should be explicitly accounted for when revising regulatory regimes in the future and that investment and maintenance possibilities for regulated firms need to adequately reflect the economic benefits of high levels of service reliability.

Similar content being viewed by others

Notes

Which Eurelectric (2006) defines as: “the ability of the electric power system to provide electricity to end-users with a specified level of continuity and quality in a sustainable manner, relating to the existing standards and contractual agreements at the points of delivery. This is followed. However, while reliability optima area priori unknown, a 1-day-in-10-years outage frequency is commonly cited (see Telson 1975 and Brown 2002).

The adverse consequences of failing infrastructure became obvious in a series of widespread power outages in 2003 and 2006, which were shown to have substantial social consequences (Bompard et al. 2011).

This applies for those who have not done so prior to its introduction, such as the UK or Scandinavian countries.

Recent policy developments in the EU extend trans-national frameworks to climate policy and for instance require the introduction of binding legislation promoting energy efficiency, ‘green’ energy production based on at least 20–27 % renewable energy sources until 2020 and 2030 respectively, the goal to reduce greenhouse gas emissions, and to enhance cross-border electricity transmission (European Parliament 2013).

This is due to the fact that failures thereof account for more than 90 % of power interruptions in Europe (Council of European Energy Regulators 2012).

These are supported by the European “Projects of Common Interest (PCI)” scheme. Improved data collection is— among others—suggested by Council of European Energy Regulators (2012, p. 58) which announces the urgent necessity to, “exchange information on continuity of supply and its regulation”, and to, “investigate continuity of supply trends for a periodic review of regulation”.

Directive 2003/54/EC (European Commission 2003) highlights the necessity that electricity supply security related aspects of electricity market regulation be considered in conjunction with price effects. For a thorough discussion of reliability valuation it is referred to Reichl et al. (2013), Bertazzi et al. (2005), de Nooij et al. (2007) or Lawton et al. (2003) for the United States.

Eurelectric (2014) presented the industry’s viewpoints, with adverse effects regulation has had on investments.

Further analyses were carried out by Jongpepier and Hulshorst (2005).

For an in-depth discussion on market structures, competition and regulatory characteristics it is referred to Depoorter (1999). In this paper regulation exclusively concerns stationary distribution network infrastructure for which the variable costs do not grow proportionally with its utilization.

Throughout the paper, the European currency, Euro (€) as well as cents (ct) are utilized; the exchange rate of for one € was set at 1.24 U.S. $ in November 2014.

As a result, GDP in Austria is found to having increased by one percent for the period from 2001 and 2011.

However, contradictory evidence exists; Zhang et al. (2005) for example, pointed out for developing countries that the mere introduction of competition does not lead to higher productivity of the regulated companies.

However, apart from regulation various factors , such as public resistance, social factors and market uncertainties, are found to hinder investments into the grid infrastructure (see Cohen et al. 2014).

This is subject to endogeneity (ownership), which once controlled for, changes the situation drastically.

This includes the increasing trans-European power exchanges, such as the introduction of smart technologies in various countries, which DSO are in many countries responsible for, thereby making them relevant for regulatory considerations, and the increasing use of renewable energy sources (European Commission 2010).

The rationale and choice for this classification and the possible channels of interaction with the level of electricity supply security can be found in the Appendix.

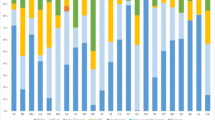

Details on regulatory development are provided in the Appendix. White indicates data unavailability in Fig. 1.

Rate-of-return (ROR) is also referred to as “cost-based” or “cost-plus” regulation, see Mueller et al. (2010).

In the EU, the majority of output schemes represent incentive-based frameworks with explicit incentives for DSO to increase quality of supply (Cambini et al. 2012b). This encapsulates the quantity of physical power demand which is primarily determined by market forces—i.e. demand and supply. Accordingly, no single incident of a lack of quantity—i.e. generation capacity—has been found to be responsible for a single power outage in the EU during the period under consideration (Council of European Energy Regulators 2014).

This paper accounts for medium and short-term changes in DSO behaviour in response to regulatory changes. Different regulatory approaches to OPEX and CAPEX exist. The emphasis is put on regulatory effects on OPEX.

This—in combination with substantial information asymmetry—led various national regulatory authorities to implement measures which specifically account for effects on electricity supply security (i.e.output regulation).

Evidence on classification is also provided by Cambini et al. (2012a), who study the different types and efficiencies of regulation schemes among distribution system operators.

SAIDI is available for all but four of the nations in the sample; these nations use comparable metrics that measure minutes of power loss due to unplanned outages. Definitions of indices are presented in the Appendix.

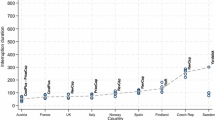

2009 is a year for which most countries reported outage duration and frequency indicators making it suitable for comparisons.

The definition of SAIDI is given in the Appendix along with a representation of the differences in the sample.

This division, which is explained subsequently, is crucial in understanding the bi-directional causality chains found to be associated with regulation.

This is done by the dummy variable incl_execptional_events. Data comparability and homogeneity is ensured for the dependent variables by the exclusive use of data from Council of European Energy Regulators (2014), which also contains a discussion of the differences in countries’ measurement methods.

Unobservable characteristics affect supply security and vary at the national level. This includes, for instance, the response time of crews and grid managers in the case of unplanned power outages, or the peculiarities of a particular grid and network protocols which are too nuanced to include in a quantitative model.

Power lines connect countries’ power lines and thus affect the levels of supply security. This is evidenced by the trans-national power interruptions such as the incident in Italy on September 28th 2003, which originated in Switzerland is one example thereof. For a thorough analysis of major power outages it is referred to Bompard et al. (2011). The increasing importance and challenges of trans-national interconnections in terms of supply security are found to be especially relevant for supply security in the future (see de Jong and Hakvoort 2006 as well as Pidlisna 2014). For instance, trans-border electricity exchange in Europe is anticipated to increase to up to 15 % of the overall power demand by 2030 from 8.5 % in 2012.

Duso (2001) for instance investigated the cellular industries in the USA, whereas Duso and Roeller (2003) provided insights into the driving forces behind endogenous deregulation decisions in the OECD and associated effects on productivity. They find substantial evidence for endogeneity and that competition has positive effects on deregulation, implying that very competitive countries tend to open up markets earlier.

This analysis focused on electricity market regulation in the United States. The presented evidence on reverse causation potentially stems from utilities lobbying against output-based schemes in regions or countries with poor electricity supply security. Conversely, public pressure from consumers may enhance the likelihood of adopting user friendly, output-based regulatory frameworks, especially in areas where electricity supply security is poor. Summarizing, the authors conclude that, “there is some indication of endogeneity, although, importantly, not to the extent of fundamentally altering our basic results” (Ter-Martirosyan and Kwoka 2010, p. 272).

The internal market legislation (European Commission 1996) implemented throughout the EU starting in 1999 required from member states the introduction of regulation where most countries did not have such a system before. Based on the longstanding experience with rate-of-return in other industries many countries adopted a rate-of-return regulation system at first (See for instance Biglaiser and Riordan 2000).

However, this applies to the non-regulated part such as generation, trading and energy balancing, not the natural monopoly part of transmission and distribution networks. Nevertheless, market openness being a structural variable can thus be controlled for.

The latter has been divided by 1000 in order to ensure homogeneous variable levels.

No inferences about the reasons thereof can be made at this stage of research.

The authors summarize the dichotomy between OPEX and CAPEX: “Operations and maintenance expenditures are examined separately to allow for the possibility that incentive regulation affects them differently, and in turn that they affect quality differently[...]Capital expenditures undoubtedly matter as well, but are highly variable, and have effects subject to long lags. Accordingly, we focus on variable costs, to which most examples of quality problems are traced.” This definition is followed throughout.

While testing for different lag assumptions this analysis refrains from a somewhat arbitrary definition of homogeneous lags for all observations. Thus, the coefficients of interest, i.e. those for the policy indicator variables, estimate the average change in reliability elicited by a regulatory regime irrespective of how long ago the regulation was implemented.

The coefficient for ror_dso, though being smaller in magnitude—and slightly less robust –is preferable in terms of supply security when comparted to purely tariff-focused incentive regulation. One explanation lies in the fact that the downward trend of network tariffs—and consequently of operating expenditures—accelerated in many cases with the introduction of incentive regulation, lending support to the hypothesis that lower network tariffs—which are found to have resulted from incentive regulation (Kratena 2011) came at the cost of less reliable levels of supply security. It is important to dwell on the fact that this might be justifiable and – based on Spence (1975)—even macro-economically efficient.

For SAIDI, this is the case also for the electricity price residential customers pay (price_residential).

Renewable energy is heavily debated in the European climate and energy policy while the necessity of public ownership of utilities is discussed intensively in industrial policy. This explains their inclusion into the model.

The dummy incl_exceptional_events is significant and positive as expected, lending to the fact that outage durations and frequencies are higher if exceptional events occur.

In addition, the applied year fixed effects are significant at the 5 % level for both, SAIDI and SAIFI models.

Coefficient’s log values need to be converted because their exponentiation would result in biased predictions for duration and frequencies.

The assessment is based on the online assessment tool http://www.blackout-simulator.com.

The hypothetical assumption here is that countries are able to change to an output-based scheme.

This calculation uses a model presented in Schmidthaler and Reichl (2014) and assumes a linear relationship of damages and outage duration during the first 60 min. The duration of power outages is compared to the last available observation in each country; with the exception of Greece, Spain, Italy, Latvia, Malta, Poland, Portugal, who report outage duration indices until 2011, this is 2012. Bulgaria reports up until 2010.

This group included Hungary, Bulgaria, Poland, Slovak Republic, Romania and the Czech Republic with outage durations ranging from 77 to 630 min.

This is relevant as these treatments are within direct political influence and discretion. The Hausman test was done independently for SAIDI and SAIFI, thus representing a two-stage-least-square setup. For estimation of the slope coefficients, the three-stage model has been applied due to higher estimation efficiency and—thus smaller standard errors.

The choice for including these instruments was driven by economic theory as presented in Sect. 3.

A set of strictly technocratic criteria was applied which are presented in Figure classification procedure.

This holds for revenues and/or prices as well.

This is opposed to ROR, which does not incorporate peer DSO’s performance.

This is summarized by Spence (1975) who concluded that: “profitability is not a sufficient criterion for deciding on the social value of quality”.

This can either be a penalty if certain criteria are not met or a bonus for keeping reliability above certain levels.

Sources are in most cases the national reports submitted to the Council of European Energy Regulators.

This is the case in the UK, Norway and the Netherlands (Council of European Energy Regulators 2012, p. 51)

This is contrary to the utilization of absolute levels of electricity supply security.

As implied by criterion 3, some incentive regimes may contain explicit mention of the ESS, but these regimes do not contain direct monetary incentives for operators to improve quality.

This is reflected in a report by the French National Regulator (CRE 2006) which states that: “Since December 2003 CRE has drawn up an activity report containing a set of indicators containing a set of indicators to be periodically filled in by grid operators”.

An example for such an exception is provided by Council of European Energy Regulators (2008, pp. 14–15): “...the Authority also reviewed the tariff components covering the allowed costs arising from service quality improvements and from the adoption of initiatives designed to control and manage demand through the efficient use of resources.”

References

Averch, H., & Johnson, L. L. (1962). Behavior of the firm under regulatory constraint. The American Economic Review, 52(5), 1052–1069.

Bertazzi, A., Fumagalli, E., & Schiavo, L.L. (2005). The use of customer outage cost surveys in policy decision-making: The italian experience in regulating quality of electricity supply. In 18th International Conference on Electricity Distribution (pp. 1–5). 18th International Conference on Electricity Distribution.

Biglaiser, G., & Riordan, M. (2000). Dynamics of price regulation. RAND Journal of Economics, 31(4), 744–767.

Bompard, E., Huang, T., Tenconi, A., Wu, Y., Zelastiba, D., Cremenescu, M., Roman, T., Valciu, A., & Voronca, S. (2011). Analysis of historic outages—deliverable d1.1 of the project sesame (securing the european electricity supply against malicious and accidental threats). Technical report, Transelectrica and Politecnico di Torino.

Braeutigam, R. R. (1989). Chapter 23: Optimal policies for natural monopolies (Vol. 2). Amsterdam: Elsevier.

Bremer Energie Institut. (2010). Anreiz- oder Hemmniswirkungen des regulatorischen Rahmens fuer Erweiterungsinvestitionen der Stromuebertragungsnetze—eine Studie fuer Amprion gmbh. Technical report, Bremer Energie Institut.

Breusch, T. S., & Pagan, A. R. (1979). A simple test for heteroscedasticity and random coefficient variation. Econometrica, 47(5), 1287–1294.

Brown, R. E. (2002). Electric power distribution reliability. Boca Raton: CRC Press.

Cambini, C., Croce, A., & Fumagalli, E. (2012). Output-based incentive regulation in electricity distribution: Evidence from Italy. Technical report, Politecnico di Torino.

Cambini, C., Fumagalli, E., & Croce, A. (2012). Output-based incentive regulation: Benchmarking with quality of supply in electricity distribution. In Proceedings 9th International Conference on the European Energy Market EEM12. Proceedings 9th International Conference on the European Energy Market EEM12.

Cambini, C., & Rondi, L. (2010). Incentive regulation and investment: evidence from European energy utilities. Journal of Regulatory Economics, 38, 1–26. doi:10.1007/s11149-009-9111-6.

Cohen, J.J., Moeltner, K., Reichl, J., & Schmidthaler, M. (2014). An empirical analysis of local opposition to new transmission lines across the EU-27. Working Paper, Energieinstitut an der Johannes Kepler Universit”at Linz.

Commission of the European Communities. (2003). Undergrounding of electricity lines in europe.

Conway, P., & Nicoletti, G. (2007). Product market regulation and productivity convergence: OECD evidence and implications for Canada. International Productivity Monitor, 15, 3–24.

Council of European Energy Regulators. (2005). 3rd benchmarking report on quality of electricity supply 2005. Technical report, Council of European Energy Regulators.

Council of European Energy Regulators. (2008). 4th benchmarking report on quality of electricity supply 2008. Technical report, Council of European Energy Regulators.

Council of European Energy Regulators. (2012). 5th ceer benchmarking report on the quality of electricity supply 2011. Technical report, Council of European Energy Regulators.

Council of European Energy Regulators. (2014). Ceer benchmarking report 5.1 on the continuity of electricity supply—data update. Technical report, Council of European Energy Regulators.

Council of European Energy Regulators. (2015). CEER benchmarking report 5.2 on the continuity of electricity supply—data update. Technical report, Council of European Energy Regulators.

CRE. (2006). Report sent to the dg tren—July 2006. Technical report, Commission de Régulation de l’Énergie.

CRE. (2010). 2009 national report and indicators—english summary—July 2010. Technical report, Commission de Régulation de l’Énergie.

Csgnetwork. (2014). Countries, capitals, latitude and longitude table.

Davidson, R., & MacKinnon, J. G. (1993). Estimation and inference in econometrics. New York: Oxford University Press. Number 9780195060119 in OUP Catalogue.

de Jong, H. & Hakvoort, R. (2006). Interconnection investment in Europe. Optimizing capacity from a private or a public perspective? Technical report, TU Delft.

de Nooij, M., Koopmans, C., & Bijvoet, C. (2007). The value of supply security. The costs of power interruptions: Economic input for damage reduction and investment. Energy Economics, 29, 277–295.

Depoorter, B. (1999). Regulation of natural monopoly in encyclopedia of law and economics. Cheltenham: Edward elgar.

Donald, S. G., & Sappington, D. E. (1997). Choosing among regulatory options in the united states telecommunications industry. Journal of Regulatory Economics, 12(3), 227–243.

Doove, S., O. Gabbitas, D. Nguyen-Hong, & Owen, J. (2001). Price effects of regulation: Telecommunications, air passenger transport and electricity supply. Technical report 0110004, EconWPA.

Duso, T. (2001). Lobbying and regulation in a political economy: Evidence from the US cellular industry. Technical report, Wissenschaftszentrum Berlin, Discussion Paper FS IV 01–03.

Duso, T., & Roeller, L.-H. (2003). Endogenous deregulation: Evidence from OECD countries. Economics Letters, 81, 67–71.

Eurelectric. (2003). Power distribution in europe—facts & figures, available at http://www.eurelectric.org/media/113155/dso_report-web_final-2013-030-0764-01-e.pdf, accessed on March 13, 2015.

Eurelectric. (2006). Security of electricity supply—roles, responsibilities and experiences within the EU—working group on security of electricity supply. Technical report, Eurelectric.

Eurelectric. (2014). Electricity distribution investments: What regulatory framework do we need?. Technical report, Eurelectric.

European Climate Assessment & Dataset. (2014). Indices of extremes—time series plots. Technical report, European Climate Assessment & Dataset.

European Commission. (1996). Directive 96/92/EC of the European Parliament and of the council of 19 december 1996 concerning common rules for the internal market in electricity. Official Journal of the European Union.

European Commission. (2003). Directive 2003/54/EC of the European Parliament and of the Council of 26 June 2003 concerning common rules for the internal market in electricity and repealing directive 96/92/EC. Official Journal of the European Union.

European Commission. (2006). Directive 2006/32/EC of the European Parliament and of the Council of 5 April 2006 on energy end-use efficiency and energy services and repealing Council Directive 93/76/EC. Official Journal of the European Union.

European Commission. (2010). Communication from the commission Europe 2020 a strategy for smart, sustainable and inclusive growth. Official Journal of the European Union.

European Commission. (2014a). Energy market—country data. Technical report, European Commission DG Energy, accessed on October 14, 2014.

European Commission. (2014b). Internal market fact sheets. Technical report, European Commission DG Energy. accessed October 14, 2014.

European Parliament. (2013). Regulation (EU) no. 347/2013 of the European Parliament and of the Council on guidelines for trans-European energy infrastructure and repealing decision no. 1364/2006/ec and amending regulations (EC) no 713/2009, (EC) no 714/2009 and (EC) no. 715/2009. Technical report, European Parliament.

Eurostat. (2014a). Electricity consumption of households converted from 1000 tonnes of oil equivalent, available at http://epp.eurostat.ec.europa.eu/tgm/table.do?tab=table&init=1&plugin=1&language=en&pcode=tsdpc310, accessed on March 4, 2015.

Eurostat. (2014b). Elektrizitaetserzeugung aus erneuerbaren Energiequellen des Bruttostromverbrauchs, available at http://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do, accessed on March 4, 2015.

Eurostat. (2014c). Gross inland consumption of energy divided by GDP (kg of oil equivalent per 1 000 EUR), available at http://ec.europa.eu/eurostat/tgm/download.do?tab=table&plugin=1&language=en&pcode=tsdec360, accessed on March 4, 2015.

Eurostat. (2014d). GDP per capita devided by 1000 at market prices, real gross domestic product per capita euro per inhabitant. Last update: 08–09-2014 available at http://appsso.eurostat.ec.europa.eu/nui/submitViewTableAction.do, accessed on March 4, 2015

Eurostat. (2014e). Half-yearly electricity and gas prices, electricity prices by type of user Code: ten00117, available at http://ec.europa.eu/eurostat/tgm/download.do?tab=table&plugin=1&language=en&pcode=ten00117, accessed on March 4, 2015.

Eurostat. (2014f). Heating degree days in Europe NUTS-2-Regions—annual data, available at http://www.eea.europa.eu/data-and-maps/data/external/heating-degree-days-annual-data, accessed on March 13, 2015.

Eurostat. (2014g). Preise von Elektrizitaet fuer Industrieabnehmer, ab 2007—halbjaehrliche Daten, Electricity prices by type of user Code: ten00117, available at http://ec.europa.eu/eurostat/tgm/download.do?tab=table&plugin=1&language=en&pcode=ten00117, accessed on March 4, 2015.

Frontier Economics. (2011). Investitionsanreize und Qualitaetsregulierung—Lehren aus der internationalen Regulierungspraxis. In Presentation at IEWT 2011, 17th of February. Presentation at IEWT 2011, 17th of February.

Giannakis, D., Jamasb, T., & Pollitt, M. (2005). Benchmarking and incentive regulation of quality of service: An application to the UK electricity distribution networks. Energy Policy, 33, 2256–2271.

Greene, W. H. (2008). Econometric analysis (6th ed.). New York: Prentice-Hall.

Groenli, H., & Haberfellner, M. (2002). Mechanismen der Anreizregulierung. Technical report, e-control.

Gutierrez, F. G., M. Schmidthaler, J. Reichl, S. Voronca, & Roman, T. E. (2013). Securing the European electricity supply against malicious and accidental threats: Public effects knowledge base, v. 1.0. Technical report, Deloitte & Transelectrica & Energy Institute at the Johannes Kepler University Linz. European Union Seventh Framework Programme, Project # 261696.

Haber, A. (2005). Entwicklung und Analyse eines Qualitaetsregulierungsmodells fuer die oesterreichischen Mittelspannungsnetze. Technical report.

Haberfellner, M., A. Koch, & Hujber, P. (2002). Liberalisierung und Strompreisentwicklung—Oesterreich und Deutschland im Vergleich. Technical report, e-control.

Heritage Foundation. (2014). Index of economic freedom. Technical report, Heritage Foundation.

Hoffrichter, A. (2011). Regulierungsrahmen fuer die Elektrizitaetsverteilnetze. Technical report, TU Berlin.

Jamasb, T., & Pollitt, M. (2007). Incentive regulation of electricity distribution networks: Lessons of experience from Britain. Energy Policy, 35, 6163–6187.

Jongpepier, A., & Hulshorst, W. (2005). Regulatory control of quality of service leads to balanced risk. Electrical Power Quality and Utilisation, 1, 3–10.

Joskow, P. L. (2011). Incentive regulation in theory and practice: Electricity distribution and transmission networks. Chicago: University of Chicago Press.

Karan, M., & Kazdagli, H. (2011). The development of energy markets in Europe. Berlin: Springer.

Kratena, K. (2004). Makrooekonomische Evaluierung der Liberalisierung im oesterreichischen Energiemarkt, working paper. Technical report, Oesterreichisches Institut fuer Wirtschaftsforschung.

Kratena, K. (2011). Gesamtwirtschaftliche Effekte der Energiemarktliberalisierung in Oesterreich. Technical Report, Oesterreichisches Institut fuer Wirtschaftsforschung.

Lawton, L., M. Sullivan, K. V. Liere, & Katz, A. (2003). A framework and review of customer outage costs: Integration and analysis of electric utility outage cost surveys. Technical report, Ernest Orlando Lawrence Berkeley National Laboratory, California.

Moeltner, K., & Layton, D. F. (2002). A censored random coefficients model for pooled survey data with application to the estimation of power outage costs. Review of Economics and Statistics, 84, 552–561.

Mueller, C., C. Growitsch, & Wissner, M. (2010). Regulierung und Investitionsanreize in der oekonomischen Theorie. WIK Wissenschaftliches Institut fuer Infrastruktur und Kommunikationsdienste.

Netherlands Bureau for Economic Policy Analysis. (2004). Better safe than sorry?. Technical report, CPB Netherlands Bureau for Economic Policy Analysis: Reliability Policy in Network Industries.

Nixon, H. (2009). Regulating energy networks for the future: Rpi-x@20—history of energy network regulation. Technical report, Ofgem.

Nordic Energy Regulators. (2011). Economic regulation of electricity grids in Nordic countries. Technical report, Nordic Energy Regulators.

OECD. (2012). National report.Technical report, OECD.

Perrin, L.-M. (2013). Mapping power and utilities regulation in europe. Technical report, Assurance Power and Utilities Sector Resident, EY.

Petrov, K., V. Ajodhia, D. Grote, & Resnjanskij, D. (2010). Third annual conference on competition and regulation in network industries. Technical report, KEMA Consulting GmbH.

Pidlisna, Y. (2014). Opportunities and challenges for interconnection investment in europe: Case example of estlink hvdc power cable between Estonia and Finland. Technical report, International Association for Energy Economics.

Poudineh, R., & Jamasb, T. (2013). Investment and efficiency under incentive regulation: The case of the norwegian electricity distribution networks.

Reichl, J., Kollmann, A., Tichler, R., & Schneider, F. (2008). The importance of incorporating reliability of supply criteria in a regulatory system of electricity distribution: An empirical analysis for Austria. Energy Policy, 36(10), 3862–3871.

Reichl, J., Schmidthaler, M., & Schneider, F. (2013). The value of supply security: The costs of power outages to austrian households, firms and the public sector. Energy Economics, 36, 256–261.

Sappington, D. E. M. (2003). The effects of incentive regulation on retail telephone service quality in the United States. Review of Network Economics, 2(4), 5.

Schmidthaler, M., & Reichl, J. (2014). Economic valuation of electricity supply security—ad-hoc cost assessment tool for power outages. Electra, 276, 10–15.

Spence, A. M. (1975). Monopoly, quality, and regulation. The Bell Journal of Economics, 6(2), 417–429.

Steiner, F. (2000). Regulation, industry structure and performance in the electricity supply industry. Technical Report 238, OECD Publishing.

Telson, M. L. (1975). The economics of alternative levels of reliability for electric power generation systems. The Bell Journal of Economics, 6(2), 679–694.

Ter-Martirosyan, A. (2003). The effects of incentive regulation on quality of service in electricity markets. Technical report, Department of Economics, George Washington University.

Ter-Martirosyan, A., & Kwoka, J. (2010). Incentive regulation, service quality, and standards in US electricity distribution. Journal of Regulatory Economics, 38, 258–273.

Uri, N. D. (2003). Service quality effects of incentive regulation on access service in telecommunications in the United States. European Journal of Law and Economics, 16, 369–390.

Virendra, K. Petrov, & Scarsi, G. C. A. (2004). Quality, regulation and benchmarking an application to electricity distribution networks citation. Regulierung der Netzwirtschaft, 29, 107–120.

Vogelsang, I. (2010). Incentive regulation, investments and technological change. CESifo Working Paper Series (2964).

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica, 48, 817–830.

WIOD. (2012). World Input–Output Database. Website, http://www.wiod.org/database/index.htm.

Woo, C.-K. & K. Train (1988). The costs of electric power interruptions to commercial firms. Technical report.

Zellner, A., & Theil, H. (1962). Three-stage least squares: Simultaneous estimation of simultaneous equations. Econometrica, 30(1), 54–78.

Zhang, Y.-F., D. Parker, & Kirkpatrick, C. (2005). Assessing the effects of privatisation, competition and regulation on economic performance: The case of electricity sector reform. Technical Report 0511, National University of Singapore, Department of Economics, SCAPE.

Acknowledgments

This project has received funding from the European Union’s Seventh Framework Programme for research technological development and demonstration under Grant Agreement No [261696]. Additional funding was provided by the Austrian Federal Ministry for Transport, Innovation and Technology under the Security Research Program KIRAS [Grant No 836307].

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Definition of dependent variables SAIDI and SAIFI

Following Reichl et al. (2008), the applied indicators, SAIDI and SAIFI, respectively, are described in Eqs. (4) and (5). The system average interruption duration index (SAIDI) is defined by

where \(n_j \) is the number of customers affected by outage \(j\), \(t_j \) is the number of minutes outage \(j\) lasted, and \(N\) is the total number of electricity customers, and a particular outage is \(j\in \{1\ldots J\}\) where \(J\) is the total number of outagesexperienced during that year. This figure is calculated independently for each nation and year in the sample.

The system average interruption frequency index (SAIFI) on the other hand quantifies the average number of outages p.a. which a customer experiences. SAIFI is defined as a measure for every installed kVA (installed capacity as kilovolt-ampere) per year. A value of 1 implies that every kVA installed per customer, experiences one power outage in the year at question. Equation (5) provides a definition of SAIFI.

1.2 Model specification and endogeneity: Durbin–Wu–Hausman Test

Endogeneity of the treatment variables was tested to identify the need for instrumental variable inclusion. Based on theoretical considerations, potential endogeneity primarily concerns the two variables ROR and output.Footnote 51

The applied Hausman tests subtracts the independently estimated standard coefficients \(({\hat{\beta }}_{SC} )\) from the estimates of the IV approach \(({\hat{\beta }}_{IV} )\). The squared sum is then divided by subtracted variances of \({\hat{\beta }}_{IV}\) minus \({\hat{\beta }}_{SC}\). The test statistics is \(\chi ^{2}\)-distributed. Based on the test outcome \(H_0\) is declined for output but not for rate-of-return. This supports the inclusion of an instrumental variable approach. The test setting was done for each linear combination of model and treatment variable, respectively. Table 5 depicts the test statistics from model highlighting that endogeneity for output regulation is supported at the 0.05 level. This is not the case for ROR. Footnote 52

The respective test statistic is testimony of the ambiguous causality chain. As a result of confirmed endogeneity, a three stage least square—3SLS—model was applied (see Zellner and Theil 1962) instrumenting for output making use of a number of instruments. In doing so, most of the statistically significant instrument variables in the first stage model show the expected sign.Footnote 53 This is the case for the number of DSO per million inhabitants (num_dso_capita), the electricity price paid by industrial customers (price_ind) and households’ power demand divided by population (el_cons_capita_kwh) whose slope coefficients are statistically significant and negative in sign.

Interestingly, the number of people living within one \(\hbox {km}^{2}\) a (pop_density) is positive indicating the possibility of an increased democratic pressure to introduce output regulation in rather urban settings. The degree of utilities’ vertical integration (pct_vertical integration), the freedom of investment (investment_freedom) and the latent proxy for utility loss due to power outages (latent_suffering_WTP_Saidi, wtp_weighted) are negative but lack statistical significance.

1.3 Regulatory classification

Following Haber (2005), Vogelsang (2010), Braeutigam (1989) and Cambini and Rondi (2010), regulatory regimes were classified into three categories which are defined subsequently.Footnote 54

1.3.1 Rate-of-return or cost-based regulation (ROR)

ROR is based on a premium on top of costsFootnote 55 determined by the regulatory authority. In many cases, DSO are granted tariffs which cover their costs, plus an allowed return on investment. ROR also applies to frameworks, within which a revenue cap is set. Most importantly, ROR is strictly quality independent.

1.3.2 Incentive or benchmark based regulation (incentive)

incentive is the envelope terminology for regulatory regimes which set tariffs based on benchmark systems.Footnote 56 Regimes which are also known by the following termini are included in the categorization: price cap, revenue cap, rate moratoria, profit sharing, banded rate-of-return, menus and yardstick regulation. Most importantly distribution tariffs depend on those of peer companies. Furthermore, tariffs are independent quality of supply and determined by the regulator based on productivity comparison with other regulated firms.

1.3.3 Output or quality based regulation (output)

Output, characterizes a family of regulatory schemes which explicitly include quality measures into a country’s regulatory framework. This type of regulation is based on mandatory rewards and punishments if standards are not met. A stringent legal framework for all affected entities is mandatory.

Figure 3 depicts the respective relationships between costs and electricity supply security. Regardless of the type of regulation, a grid operator is assumed to exhibit profit maximizing behavior. However, this does not paint a full picture. In terms of social welfare, DSO profits ought to be considered in conjunction with consumer rents.Footnote 57

Thus, incorporating quality of supply standards into the tariff negotiations between regulatory authority and DSO puts a value on the good of electricity supply security. As depicted in Figure 3 on the very right, only output regulation requires a binding monetary reward or punishment (depending on deteriorations or improvements of service reliability) which apply whether certain standards are met.Footnote 58

The process of regulatory classification in this paper was strictly conducted along the following procedure:

1.3.4 Classification process

-

1.

Missing information on regulation schemes leads to classification as no reg—and thus—omission from the sample.

-

2.

In regulatory practice, incentive and output regulation schemes share many common properties. A scheme is classified as output if and only if the source usedFootnote 59 yields precise information that mandatory monetary penalties or rewards are involved in regulation.

-

3.

Whenever monetary remunerations to customers (e.g. payments, or rate reductions) exist in the case that utilities fail to provide sufficient levels of electricity supply security to consumers,Footnote 60 the respective regulation regime is categorized as output.

-

4.

The same applies to ROR regulation. Although the overlap is less pronounced compared to incentive and output, the most distinctive criteria differentiating ROR from output is the lack of quality controls. The differentiation between incentive and ROR is straightforward as various studies (Vogelsang 2010 or Braeutigam 1989) elaborate on this issue.

-

5.

If the regulatory regime recognizes positive and/or negative trends of electricity supply security Footnote 61, or if boni are awarded due to reliability improvements, output is assigned.

Summarizing the classification procedure, Table 6 includes the technocratic methodology used for the categorization of the regulation schemes of the European countries subject of this paper. Necessary and sufficient conditions are based on these characteristics.

The classification strictly followed the conditions of Table 6 for every country and year in the panel. National reports—such as CRE (2006) and CRE (2010) for the case of France—on regulatory practices were scanned with regards to each criterion. Those regulatory schemes that satisfied all of the necessary, or at least one of the sufficient were classified according to this scheme. While incentive and output regimes may contain many of the same elements they are distinguished first and foremost by criteria 1 and 2, which provides a clear delineation between the two regulation types.Footnote 62

In addition to significant progress with regards to regulatory designs, evidence for enhanced consumer rights exists. Council of European Energy Regulators (2012) finds in this regard, that: “In 16 countries, the network user has the right to be reimbursed (or to receive reduction of network tariffs) after a very long interruption. In 4 countries, compensation relates to a maximum number of interruptions in one year. In 5 countries, compensation applies for planned interruptions, with different implementation solutions (related to the duration or to the notice).” In case a member state implemented frameworks for customer compensations, its regulatory scheme for the year in question is classified as output. However, a necessary condition for the categorization as output requires strict legal frameworks. A vague threat to change regulation or reward the DSO in the future is not sufficient for a regulatory scheme to be classified as output regulation.

1.3.5 Classification case study: regulation in France

The applied classification procedure for France provides a vivid example. Data for France’s regulation approach are available for the entire study period (1999–2013) and stem from the publications of the French national energy regulator (CRE 2006 and 2010). Up until 2009, the French regulatory criteria were neither combined with monetary incentives related to reliability of any kind, nor were tariffs for networks set based on a benchmark system without security of supply indicators. Thus, France exhibited a rather puristic ROR system. Starting in 2003, an—at first—voluntary measurement of electricity supply security was started.Footnote 63 However mandatory penalties for not being able to provide certain reliability levels were introduced as of 2009. Starting in 2009 and stretching until the end of the period under consideration, a new tariff system for the use of the public French transmission and distribution networks (TURPE 3) was introduced: “... includes incentive mechanisms aimed at controlling manageable operation costs, at improving quality of supply and service, as well as minimising the cost of purchasing losses on the networks.” (CRE 2010).

For the case of France, the applied classification is based on a stringent legistic framework which defines the monetary (dis-)incentive for deteriorating or improving levels of electricity supply security. These considerations of reliability are the necessary and sufficient conditions to fall into the category output regulation as of 2009. Thus, France provides a vivid example of a significant change in the regulatory framework from ROR to output.

1.3.6 Country-specific data on regulatory classification

Using the outlined classification procedure as well as the available reliability indices led to the following assessment of EU member states.

-

Austria Reliability indices for Austria are available since 2002. Austria introduced rate-of-return regulation in 2001 and switched to incentive regulation in 2006 which is still in use (Frontier Economics 2011).

-

Belgium Reliability indices are available since 2011. ROR regulation was applied from 2009 to 2013 (Perrin 2013).

-

Bulgaria Reliability indices for Bulgaria are available since 2008. Bulgaria implemented incentive regulation in 2005. In 2010, Bulgaria introduced quality criteria to the DSO regulation, which is still in place, rendering it output (Council of European Energy Regulators 2012).

-

Cyprus Reliability indices are available since 2012. ROR regulation is prevalent for 2012 which supply security indicators are available (Council of European Energy Regulators 2012).

-

Czech Republic Reliability indices are available since 2004. The Czech Republic introduced regulation, which was a revenue cap method, in 2005. Even though strong support for including quality measures were considered in 2009, no such parameters were included in the new incentive-based revenue cap regulatory regime which shall be applied from 2010 to 2014 (Council of European Energy Regulators 2012).

-

Denmark Reliability indices are available since 2007. Denmark implemented a rate-of-return regulation scheme in 2000. It switched to price cap regulation in 2004 which did not include quality parameters. This changed in 2008, for both TSO and DSO, when Denmark included quality measures thereby assigning it output (Council of European Energy Regulators 2012; Nordic Energy Regulators 2011).

-

Estonia Reliability indices are available for 2005 until 2011. In this period ROR was the prevailing regulatory scheme.

-

Finland Reliability indices are available since 1999. In 2005 Finland switched from a rate-of-return regime to incentive regulation, with quality controls added in 2008 (Nordic Energy Regulators 2011).

-

France Reliability indices are available since 1999. ROR was in place until 2008. In 2009, France switched to an incentive-based regulation including quality requirements (Council of European Energy Regulators 2012).

-

Germany Reliability indices are available since 2006. Germany had ROR in place until 2008, succeeded by incentive regulation which included quality of supply standards as of 2012 (Cambini and Rondi 2010).

-

Greece Reliability indices are available since 2008. In 2008 on Greece started to collect quality of service indicators. In the time period from 2008 to 2013 a rate-of-return regulatory scheme was in place.

-

Hungary Reliability indices are available since 1999. Hungary used incentive regulation since the mid 1990s. Quality incentives were added in 2003, for DSO (Council of European Energy Regulators 2005).

-

Ireland Reliability indices are available since 1999, as “customer minutes lost” the same as Britain. In 2001 Ireland introduced output. These quality controls are considered an incentive to improve quality of supply (Council of European Energy Regulators 2005).

-

Italy Reliability indices are available since 1999. Through 1999, Italy used rate-of-return regulation. As of 2000, Italy introduced incentive regulation with quality incentives for the DSO. This system of regulation is still in place today. Nevertheless, this regulatory framework deviates from other incentive-based regulation schemes.Footnote 64 The type of regulation thus includes quality measures rendering it output regulation.

-

Latvia Reliability indices are available since 2007. From 2007 to 2013, ROR was the prevailing regulatory scheme.

-

Lithuania Reliability indices are available since 2005. Lithuania introduced a price cap system in 2002 (50/50 price/revenue cap combination for DSO). This system evolved in 2008 to include compensation payments to the customer, who lay claims in the event of failure to provide a high quality energy supply making it output in this analysis (Council of European Energy Regulators 2005 and 2012).

-

Luxembourg Reliability indices are available since 2011. ROR regulation was the prevailing regulatory regime.

-

Malta Reliability indices are available since 2001 with ROR being the regulatory framework of choice.

-

The Netherlands Reliability indices are available since 1999. Until 2003 regulation included a set of set minimum quality standards. For violations of these standards the grid operator had to pay compensation for outages longer than 1 h. During the second regulation period the Dutch regulators use a yardstick competition mechanism with integrated price and reliability regulation, which was put in place in 2005 rendering it output (Netherlands Bureau for Economic Policy Analysis 2004).

-

Norway was included for comparison. Reliability indices are available since 2005. Regulation included a revenue cap with quality controls rendering it an output-based scheme (Nordic Energy Regulators 2011).

-

Poland Reliability indices since 2008. Starting in 2009 an incentive regulation without any quality measures has been in place, while prior to that Polish DSO were still rate-of-return regulated (Council of European Energy Regulators 2012).

-

Portugal Reliability indices are available since 2001. Portugal uses incentive regulation for DSO which with added quality incentives as of 2003. ERSE (the national regulator) introduced an “automatic payment of compensation for non-compliance with the individual standards of commercial quality of service” (Council of European Energy Regulators 2005).

-

Romania Reliability indices since 2008. After one year of rate-of-return regulation Romania introduced incentive in the first regulatory period which was characterized by a revenue cap with profit sharing. In the future (second period) Romania will implement output regulation (Perrin 2013). These classifications were approved by Transelectrica Romania, the national TSO.

-

Slovak Republic Reliability indices are available since 2009. Though being slightly different, the index is recorded in a manner very similar to the SAIDI index. In this period, the Slovak Republic had incentive regulation scheme without any specific quality measures.

-

Slovenia Reliability indices are available from 2008 onwards. In this time frame Slovenia had incentive regulation scheme without any specific quality measures; quality standards were added in 2011 (Council of European Energy Regulators 2012) characterizing it as output-based regulation.

-

Spain Reliability indices are available since 1999. The index includes average minutes of power outage experienced per customer excluding exceptional event as the TIEPI and NIEPI indices. In 1999 and 2000 an incentive regulation without quality measures was in place. After 2000 quality criteria were introduced (Cambini and Rondi 2010; Council of European Energy Regulators 2005) rendering it output.

-

Sweden Reliability indices are available since 2004. During this period the regulatory scheme consisted of efficiency targets with quality controls designating it output regulation (Nordic Energy Regulators 2011).

-

United Kingdom Data on average minutes of power outage experienced per customer excluding exceptional events for Great Britain are available since 2002, called “customer minutes lost”, this is a similar measure to SAIDI. Great Britain introduced “Standards of Performance” relatively early, in 1991. It has since been using quality standards in further developed regulations (Council of European Energy Regulators 2005) and thus falls into the output category.

Table 7 depicts this classification indicating a persistent move away from ROR in most European countries while incentive and output-based regimes have increased substantially.

1.4 Summary of variables

Table 8 presents a summary and descriptive statistics of the control variables used in this paper.

Rights and permissions

About this article

Cite this article

Schmidthaler, M., Cohen, J., Reichl, J. et al. The effects of network regulation on electricity supply security: a European analysis. J Regul Econ 48, 285–316 (2015). https://doi.org/10.1007/s11149-015-9277-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-015-9277-z

Keywords

- Electricity network regulation

- Supply security

- Reliability

- Infrastructure enhancement

- Econometric Analysis