What this means for an intermediary

Updated 12 May 2025

If you’re an intermediary who does not operate Pay As You Earn (PAYE) on workers payments you must submit reports return details of all workers they place with clients.

You:

- must submit these to HMRC at least once every 3 months.

- decide how often you need to upload and send your reports — for example this might be weekly, monthly or once for each period

If you only introduce workers to clients or supply workers to other intermediaries, and you are not involved in any arrangements that follow, you do not need to send reports to HMRC.

1. Who uploads and sends the report

You must send a report to HMRC if the following conditions all apply at any time in a reporting period. You:

- are an agency or intermediary that supplies the services of individuals to a client

- have a contract with a client or clients

- provide more than one worker’s services to one or more clients because of your contract with those clients

- provide the worker’s services in the UK - or if provided overseas, that the person is resident in the UK

- make one or more payments for the services (including payments to third parties)

Where you have not supplied workers in a specific quarter, you must file a ‘nil report’ by the deadline date.

If you supply workers to the intermediary that has the contract with the client, you do not have to send a report. You’ll have to provide details of the workers you supply to the intermediary with the contract.

These conditions can include situations where you:

- supply both workers and materials

- supply different and/or substitute workers

You must provide details about workers and their engagements. This includes engagements they are working on and those that ended in the reporting period you’re sending a report for.

If you pay the worker in a different period to when they worked, you can either include their details on the report about the period:

- they worked in, if it’s before the deadline for sending your report

- the payment was in and leave ‘end date of engagement’ blank

You must provide the payment details for workers where you do not operate PAYE. This includes:

- overseas workers, who have to pay tax in the UK

- payments where the worker is working in the UK or working temporarily abroad overseas

- Construction Industry Scheme workers where workers are supplied to an end client - the gross payment before any deductions, including any VAT

You must provide a report for each reporting period unless you:

- supply workers’ services at sea in the oil and gas industry wholly on the UK continental shelf

- do not provide more than one worker’s services to a client or make one or more payments for services for an entire year

- tell HMRC you are no longer an employment intermediary

You do not have to include details of workers who:

- do not have to pay tax in the UK

- are your own employees

- you do not find work for in a period or who are not paid during a period

- provide their services entirely from their own home or premises not managed by the client - unless they have to because of the services and work they provide to the client

- are actors, singers, musicians, other entertainers, or a fashion, photographic or artist model

You do not have to include payment details where they are already included as part of a payroll submission by any other organisation.

Where your business is no longer an intermediary, you must tell HMRC.

You can both submit a completed report and tell us you have stopped being an intermediary in the same quarter.

You can access forms which allow you to:

- upload a report

- upload a nil report

- advise you are no longer an intermediary

by scrolling through the screens when using the reporting template.

1.1 Examples

In both examples, Intermediary 1 must provide HMRC details of all workers and their payments where they did not operate PAYE. They must include a reason why they or whoever has a contract with the worker did not operate PAYE.

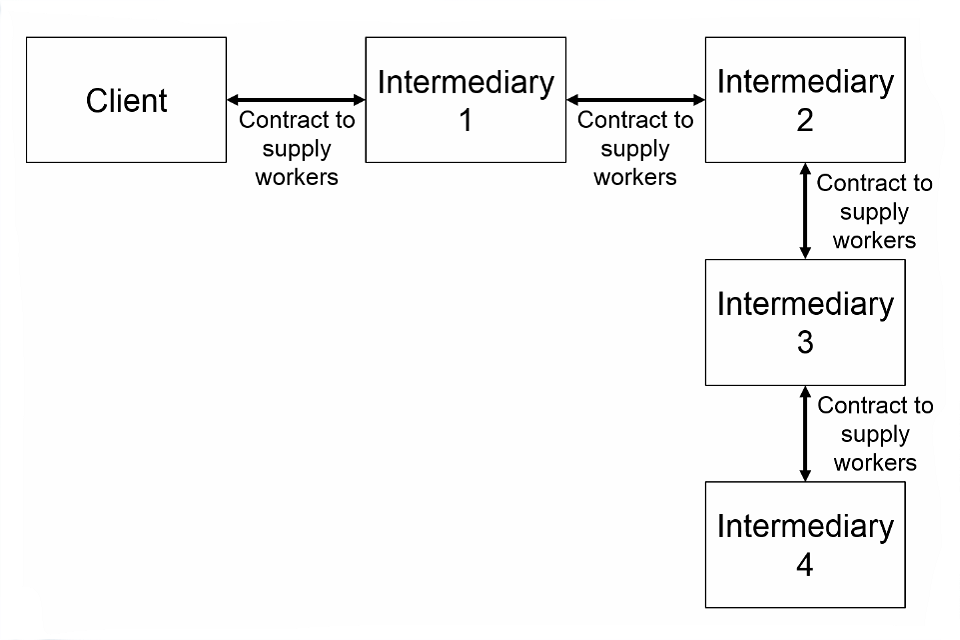

Example 1

Intermediary 1 has a contract to supply a client with workers. Intermediary 1 contracts Intermediary 2 to supply workers.

Intermediary 1 is unaware that Intermediary 2 separately subcontracts to Intermediary 3, who separately subcontracts to Intermediary 4.

Image showing the contract between a client and Intermediary 1, Intermediary 1 and Intermediary 2, and then the sub-contracts between Intermediary 2 and Intermediary 3, and Intermediary 3 and Intermediary 4.

Intermediary 1 must get all the information they have to include in their report to HMRC from Intermediary 2, including any workers supplied by Intermediary 3 and 4.

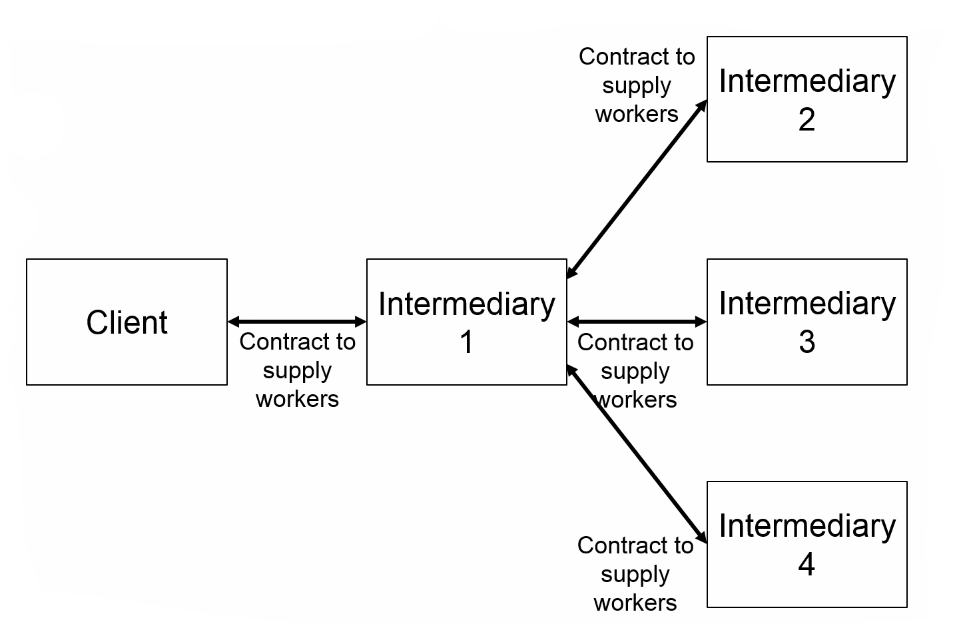

Example 2

Intermediary 1 has a contract to supply a client with workers. Intermediary 1 has separate individual contracts with intermediaries 2, 3 and 4 to supply workers.

Image showing the contract between a client and Intermediary 1 and the contracts between Intermediary 1 and 3 other intermediaries.

Intermediary 1 must get all the information they have to include in their report to HMRC from intermediaries 2, 3 and 4.

2. Personal service companies

One-person limited companies, or personal service companies (PSC), that only supply a client with one worker do not have to send reports to HMRC.

The intermediary that has the contract with the end client will include workers supplied through an intermediary in the report sent to HMRC.

A PSC is an intermediary if they supply more than one worker, a substitute or other labour including any subcontracted workers. If the PSC operates PAYE on the workers’ payments, they do not have to send reports to HMRC.

If the PSC does not operate PAYE on the workers’ payments, they will have to send reports.

If the PSC is supplied through an intermediary:

- the worker’s details (usually the director)

- the company name and registration

- the amount of the payment

will need supplied and included in the report of the intermediary that has the contract with the end client for submission to HMRC.

3. How to send reports to HMRC

3.1 Template

You must use HMRC’s report template to create reports.

You should use a fresh template for each report submitted so that data from previous reports cannot corrupt your latest report.

3.2 Online service

HMRC have an online service for you to upload and send your reports.

You can upload and send up to 13 reports at a time and as many reports as you need to throughout the reporting period. You can decide how often you upload and send your reports. This could be weekly, monthly, once for each period, or whatever fits in best with how you work.

You must enrol for the service to be able to use it. To enrol you must have an:

- HMRC online account, also known as a Government Gateway account

- employer PAYE reference

- Accounts Office reference

Your HMRC online account must be an ‘Organisation’ account.

When you sign in, the service uses your PAYE reference and accounts office reference as part of the report.

When you use the service, you have to state that the information in the report is correct before you can send it to HMRC.

3.3 If you do not have a PAYE reference

If you need a PAYE reference so you can send payroll submissions to HMRC, you need to register as an employer.

3.4 Send reports with errors

You’ll be able to send reports that contain formatting errors and missing data. If you do this you will receive an error message. You may receive a penalty if your reports are late, incomplete or incorrect.

3.5 Check your report for formatting errors

You can use the online service to check your reports for errors. To do this you:

- upload a report in the same way as if you were going to send it - drag and drop or browse and select

- check the report for errors

- see the result - where and what any formatting errors are

As long as you do not click or select any buttons that say ‘accept and send’, your reports will not be sent to HMRC.

4. Deadlines and penalties

4.1 Deadlines

You must send HMRC your reports, by each reporting period’s deadline or you may receive a penalty. The deadline is one calendar month from the end of the reporting period.

You can select and remove a report after you have sent it. You can also upload and send more reports if you need to. You must do this before the next reporting period’s deadline.

If you remove all reports after a period’s deadline when the original deadline has passed and the period does not have a report, you may receive a penalty for a late report, unless you:

- upload and send a new report (or reports)

- send a NIL report

- tell HMRC you are no longer an intermediary

| Reporting period | Deadline date | Date you can remove a report by |

|---|---|---|

| 6 April to 5 July | 5 August | 5 November |

| 6 July to 5 October | 5 November | 5 February |

| 6 October to 5 January | 5 February | 5 May |

| 6 January to 5 April | 5 May | 5 August |

4.2 Penalties

If your report is late you will automatically receive a penalty.

The number of offences in a 12 month period impacts the penalty amount.

The amounts are:

- £250 - first offence

- £500 - second offence

- £1,000 - third and later offences

If you submit a late report, but at least 12 months have passed since the last time you were late, it will be treated as a first offence.

If you submit a report that is incorrect, penalties may apply. An incomplete report, for example a report where any information is missing, will count as an incorrect report. Penalties for incorrect reports will be determined on a case-by-case basis.

If you replace an incorrect report before the deadline of the next reporting period without being asked to, HMRC will consider this when they decide if you have to pay a penalty.

If HMRC finds that you should have submitted a report and you have failed to do so, you may also receive a penalty.

Where there is a continued failure to send reports, or where reports are frequently sent in late, you may receive a penalty of up to £600 every day that you are late.

There is a right of appeal for these penalties.

4.3 Appealing against a penalty notice

If you have received a penalty notice you can appeal an employment intermediary penalty using the online form.

5. Information in the report

If you are responsible for sending the report to HMRC, you must include:

- your full name, address and postcode

- the worker’s personal details

- the engagement and payment details

If your name or address has changed you must tell HMRC about a change to your business.

Read about how to use the employment intermediaries template for specific details about the information needed for the report.

HMRC has provided a technical specification for software developers and intermediaries to allow them to develop software for their clients or themselves.

6. Record keeping

You must keep information, records and documents that prove what you sent to HMRC was correct.

This information should include any documents that show:

- who was paid

- how you worked out the amount you reported

- why you did not operate PAYE on the worker’s payments

- the worker’s payments were already included in a payroll submission by any other organisation

- why you left out required information or sent your report late

HMRC may ask you for this information.

You should work with the workers, other intermediaries involved in supplying the workers, and the clients to get suitable evidence. HMRC must be satisfied that you did not have to operate PAYE on their payments.

You must keep documents in the form that suits you best for at least 3 years as evidence of the reasons why you did not operate PAYE on workers’ payments.

7. More information

If you need help to use the service or template, select or click ‘get help with this page’ on any page inside the service. You can provide your name, email, what you were trying to do and what you need help with.

Read HMRC’s employment status for general status and intermediaries enquiries. The Employment Status Manual(ESM) provides more detailed guidance on employment status, agency legislation and intermediaries reporting - ESM2029.